Bitcoin futures have now launched. Immediately preceding the start of the launch, Bitcoin dumped $1000 in the hours leading up to the launch, but came right back and was even stronger within minutes of the futures launch.

|

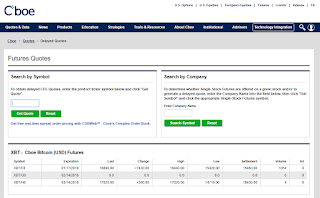

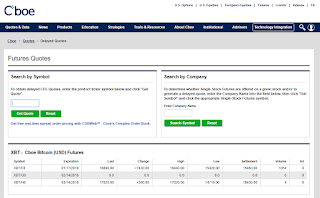

| Bitcoin future volume - first 3 hours of launch |

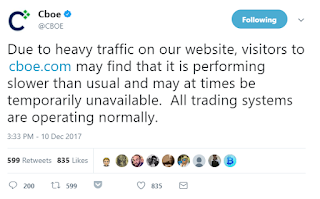

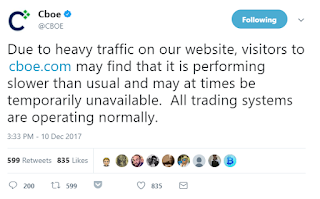

Trading was volatile on Coinbase but then settled down. The CBOE's website was inoperable and a tweet by the CBOE was sent apologizing for the slowness.

|

| CBOE Tweet Post Bitcoin Futures Launch |

Personally I could see a push higher for bitcoin based on some being fearful of futures and moving to the safety of fiat currencies or other cryptos. Without the huge crash thus far those who moved out will either move back for fear of missing out or as a planned strategy to hedge risk. The most interesting thing about the addition of futures is that the gap in prices from GDAX / Coinbase to others such as BitFinix has narrowed. This spread could have to do with certain investors moving away from Coinbase and to Futures where there is also an inherent safety mechanism of not actually trading real Bitcoins, which can be: hacked, stolen, or simply lost. Spreads have been $400-800 in days prior to launch and now the spread has come down to as little as $100.

Future trading has been light. 3 hours in and we have just over 1,000 contracts that have traded hands. The price for the futures contract has been well above the current spot price. The above is a screenshot of the CBOE volume with pricing.

For those that don't have a COINBASE account,

here is a link that gives you

$10 off your first purchase. For those that want a physical BITCOIN to act as a fidget spinner, white elephant gift, or novelty item

here they are available to purchase on Amazon.

Comments

Post a Comment