In this post I will dissect why you should NOT play around in CEI. But first you must learn a little bit about me.

In this post I will dissect why you should NOT play around in CEI. But first you must learn a little bit about me. Just a quick little background for you. I am 38 and I have been investing since I was 8, I was born in 1981. I started trading in 1996 back when stocks still traded in fractions. I used to trade with my good friend in the library during study hall back when commissions were costly, information was sparse, and very few were trading. I was pre-accepted to the University of Wisconsin based on my outstanding grades, achievements, and ACT score. I worked half a dozen jobs as well, was involved with clubs, had half a dozen different social groups and Varsity lettered in two sports at a large division 1 high school. Along the way I was ridiculously good at real-time strategy games, won tournaments in NBA Jam, Street Fighter, Goldeneye, Mario Kart. Won every single match in the state tournament, unfortunately one match doesn't carry a team. Drank beers with the cool kids and played Magic the Gathering in Alpha/Beta/Unlimited with the dorks.

In 2000, while attending the University of Wisconsin, I sold my first internet company out of my dorm room at 19 years of age. It was to a publicly traded NASDAQ listed company - my company was a niche equity analysis firm that amounted to a blog with good readership back in the day. I started my second company which was a consumer review company... I love HELPING people making buying decisions as much as I love finance. It wouldn't last though as I was quickly sued by a competitor. However, they did offer me a job at 19 to come to San Francisco and work at the startup and would direct a development team of six with a base salary of 75k + benefits. I turned it down but I would go on to excel at Wisconsin graduating with honors, landing the top job out of the business school (finance), and even turning down lunch with the Dean for my academic achievement, to be a part of a Playboy photoshoot, as a male may I add.

I'll fast forward pretty quickly, but I landed a top job back in the day and quickly excelled and was promoted again and again until I was making around 500k a year in 2006. I made my first million by 24 and my second as well and that is when I checked out from making money. Actually I started hating money and so I retired at 28. My company tried to retain me with a lucrative employment agreement but I turned it down and opted to pursue athletics again. I quickly became very good at athletics, but only because of my relentless pursuit of excellence. I turned professional a few years later. I had a very successful career as an athlete on the back of hard work but not talent. Now I am retiring for the 2nd time, but along the way I have never stopped trading and I have never stopped helping people make better decisions. I simply love them both.

|

| Look at pumps bragging about stealing your lunch money |

If you are a full-time professional penny-stock trader and a professional great, you already know what I am going to say. Nothing to see here. My goal is to make sure no honest person just "hoping to get rich" is scammed by absolute garbage like CEI. I have had too many people on StockTwits message me about losing their kid's college fund, all their money, and their livelihood to sit by and watch the carnage.

For the record I am not short, have never been short this. I did try to initiate a short today but there were no shorts to borrow. My broker called me, proactively no less than five times today to tell me this. I trade with an extremely reputable broker and my asset base is exceedingly large. This is NOT investment advice please do your own research.

SO, why are you invested in this? The professional penny-stock trader has years and years of experience and does this full-time. You think you can beat a professional? Think again. They will pump absolute garbage, often downright fraudulent companies, using their own fraudulent tactics to spread disinformation in an attempt to get as many suckers as possible to buy into these plays. You are the sucker. I am sorry to tell you. And if you have never watched The Sting you should, because you would then know that sometimes scammers let the scammed win one or two, so they can scam them for an even greater amount down the road.

Unless you are a professional, and a fraudulent one at that, stay away from this and penny-stocks. It is a losing strategy.

Is CEI worth anything

Financial StatementsDo you know how to read financial statements? Let me explain some numbers to you. The company had revenue of $110,000 last quarter. A $110,000!!!! Yet the direct costs, not the total costs, it would be like the gas for you to drive to work, cost over $270,000. Would you go to work and work 40 hours a week to pay your company $174,000 for the privilege to say you are employed??? Of course not!!! You would be better of staying at home and not owing $174,000.

Despite this the company traded at valuation of over $400,000,000 today.

|

| $110,000 dollars of revenue - what a joke |

At today's price that Price to Sales ratio is over 1,000 P/S while normal P/S of companies that actually make money in the oil & gas industry could be more like .25. That is 4000x more expensive. To put it a different way, Wal-mart's share price would have to be $172,411 to be roughly the same valuation. Would you pay $172,411 tomorrow for a share knowing that today it was $112.

Does this look like a reputable company?

Honestly does this website look like a real company? Seriously, I know this Bitcoin-Bear (actually long bitcoin at moment) blogger template is no good, but these super stock photos make it look like someone put up the website in 3 minutes.

|

| Seriously, did they pull the Oil and Gas template out of Frontpage 2000? |

|

| No Investor Presentations? |

|

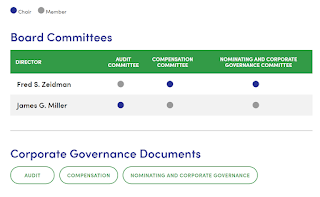

| What, impressive board committees |

Oh those corporate governance documents. Geez these look like more templates. It is like they bought a turnkey "ShamWow Oil Company in Box" for $99.99 on eBay. All business filings included!!!! Oh and what is Lucas Energy??? Is Lucas Energy the name of their prior shamwow business that has filed for bankruptcy numerous times and defaulting on loans over and over?

|

| Boilerplate documents with Lucas Energy name??? |

So total normally to start a company and keep changing its name numerous times after taking out loans and defaulting over and over again

|

| Oh that is nice, Lucas Energy was an old name but yet they couldn't even spend $99 to write new boilerplate documents for website |

Oh so does Camber have any employees except a couple of shamwow owners? Totally normal for there to be no headcount on legitimate companies

|

| Whaaaattt, no employees??? |

And yet this company with $110,000 of Q1 revenue, I made more per quarter at 24 in 2006 and yet is worth $400,000,000 yes that is million. What are you people snorting to be buying and selling?

To be clear I haven't even gone thru the documents of this company and their filings. I don't need to though either. I shouldn't even be spending time on this tonight but I like helping good people save their hard earned money. This company is worth nothing. I don't need to read about what smoke over here and what mirror over there. I checked with some contacts, I invest heavily in the oil patch and nobody has ever even heard of this company. Yet the StockTwits board was lit today.

This is trading on greater fool theory. And that is a legitimate trading strategy and professional penny-stock traders know this. It is on the basis that you will find a greater fool to take your shares which you might, but this is a deadly game of musical chairs and you will lose. Maybe not this time but in the long run you will.

If you made it this far I will give you my best tip for a legitimate 10-bagger. This is not a recommendation to buy or sell but since I love Oil & Gas and CEI is technically oil I thought I would highlight just to show you what cheap OIL is. Oil in general is so cheap compared to the rest of the market and was the only sector down in Q1Q2 2019. Down 14% while everything else is up big. Many of the stock are deeply deeply undervalued. But CEI trades at valuations far and above even the greatest growth stories in the entire market. Names like Shopify only have a P/S of 35!!!

Anyway, on with the 10-bagger. COVIA (CVIA) is a frac sand company. Most wells in the US are now frackked with frac sand and CVIA makes frac sand. There is actually a lot of processing that happens to make the right sand, in to the right rock-shattering product. Last year was looking to be a banner year for frac sand. It turns out that more and more sand was being used per well to drive greater oil yields. However, they also found out that there were sand sources closer to drilling locations that could also be processed and worked instead of what was called Northern White Sand (NWS) which mostly comes from Wisconsin and is known for it hardness quality of mainly quartz. However, NWS is expensive to ship via rail to the wells.

Anyway sand stocks, like the rest of oil have been obliterated and left for dead. Most of the frac sand companies hedge their bets by opening frac sand plants that were local (we call in-basin) as well. The cost of shipping sand is incredibly expensive and oil and gas companies have a lot of debt and anything they can do to reduce the cost of fracking, including the cost of sand is good for their margins. Although local sand isn't as effective, the O&G companies didn't care as it saved them money in the short-term although NWS is still needed for deeper wells for its sheer strength in cracking rock.

Anyway sand stocks, like the rest of oil have been obliterated and left for dead. Most of the frac sand companies hedge their bets by opening frac sand plants that were local (we call in-basin) as well. The cost of shipping sand is incredibly expensive and oil and gas companies have a lot of debt and anything they can do to reduce the cost of fracking, including the cost of sand is good for their margins. Although local sand isn't as effective, the O&G companies didn't care as it saved them money in the short-term although NWS is still needed for deeper wells for its sheer strength in cracking rock.

Nonetheless, Covia responded quickly by building two plants but frac sand became such big business that there was quickly too much frac sand supply and demand was falling as price crashed in Q4 2018 down to $45 a barrel for oil. This drove frac sand prices below what is even profitable and we have watched many frac sand producers go belly up. The market is coming into balance with April 2019 looking like rock-bottom for sand prices.

Now, Wall Street keeps valuing Covia as a frac sand play when they are 50% frac sand, 50% industrial business. Their industrial business makes sand that goes into tiles, glass (beer bottles), roofing shingles, paints, and golf bunkers. They have the #1 bunker sand on the market!!! Anyway. Covia has a 212 market cap valuation but did 1.84 billion dollars in revenue last year!!! That is a price sales ratio of .12. Remember that 1000 price sales ratio of CEI. Geez that is over priced.

Yesterday we had a fundamental change in how Wall Street has to value Covia. That is because Covia divested a non-core asset. A single lime (limestone) producing plant. They sold that plant in a deal that will close in Q3Q4 for a $135 million in cash. They need that cash because they also have 1.6 billion dollars in bonds that are due in 2025 and the frac sand part of the business is not producing as much profit right now as they hoped.

However, again, they have ~40 plants. This one plant accounted for ~2% of revenue in 2018 ($48 million). Which means they sold it for 2.8 P/S yet the company is only valued at .12!!! And they have ~39 more. If they sold each for $135 million they would get $5.4 billion dollars. If you subtract the $1.6 million in debt and add in the $100 million in cash they have as-is that makes the company worth $3.9 billion on paper but yet the market cap is only 212 million.

|

| Covia Plants |

So this assumes a fixed average for the plants if sold. In reality this one plant accounted for $15 million in gross profit of a total of $215 million for entire industrial business in 2018 so it was slightly more profitable than the average plant but it was also a non-core asset meaning it wasn't their core-competency and distracting them from their core-competency which is sand. It is impossible to say if they could sell the other plants and what for but if they did using this math it would be ~$3.9 billion for shareholders to pay whatever!!! Yet you can buy the whole company for 215 million. In reality though, no, many shareholders are not going to sell. To buy the whole company you are going to have pay a lot more. And CVIA is 35% owned by a monster company called Sibelco and they aren't selling. No way. This stock was $27 last year. But yes you can buy some shares now and own a piece of this. Yes I am long and strong this name and I am not giving up my shares except at much higher prices. They are simply woefully undervalued. Covia is a name I am happy to be invested in when the overall market's musical chairs stops and their valuation already discount this.

Hopefully you can see that for a company of 110,000 in Q1 revenue at a price of 400,000,000, just how ridiculous CEI is to a company like Covia which is a real company, with awesome products that we all use, that you use every day of your life, you just don't know it.

Covia is currently way oversold. It is down from $7 dollars in April to $1.63 today. The fundamental sale of this one plant proves that there are willing buyers to buy these plants at 25x what value Wall Street is putting on them. Wall Street is going to have to revise their estimate going forward. This stock is heavily short, thinly traded, and very low float. It is a recipe for a short-squeeze of massive proportion. Sure Wall Street shorts may be able take it down another 10-25% but I feel a lot better owing a company at a price to sale ratio of .12 than 1,000.

Do me a favor. If you made it this far. Please please just watch the movie The Sting. It is a total classic and you will be much wiser for it. If you really want to learn about investing. Not trading, investing. Read Warren's Buffet bible. Lastly I would encourage to to take a look at a Covia presentation. They can be really interesting.

Ciao,

- BB

Is there any way you would be willing to help me learn about investing and stocks? Or maybe just a push in the right direction, as I am struggling to navigate through learning this market correctly.

ReplyDeleteYes I would suggest starting with the following. Linked below. It is a classic. I will also say that markets are dynamic and just because something is working today doesn't mean it will be working tomorrow, next week or next year. https://amzn.to/2YLLAXt

DeleteThis comment has been removed by the author.

ReplyDelete